Well this has been fun [grimace emoji]. Did I want to know the finer points of bank Repo facilities? Not really, but among all the many market signals that looks to be a big one. The next big trigger point is NVIDIA results on Wednesday.

The former is a general bellwether for financial health of a nation - do banks have enough liquidity to fund spending? The Fed has been doing Quantitative Tightening - QT - taking money out of the economy, mainly to control inflation, plus there has been a long government shutdown that froze a lot of the usual spending.

The Repo facility, briefly, is an overnight pawn shop where banks temporarily hand over their high-quality collateral (like Treasury bonds) to get cash, then buy it back the next day.

It's the financial system's emergency liquidity backstop that prevents short-term cash crunches, using Treasury bonds as collateral. The critical point: in September 2019 when this market froze, the Fed could rescue it because Treasuries are government-backed, but today's stress is also in private credit markets (£1.3 trillion) where no such Fed rescue mechanism exists.

Consensus on that (after letting X currents wash over me - then having a shower) is pending implosion or higher highs if people trust the robustness of NVIDIA results. How can one company be so central? Clues are in the amount tech firms are contributing to US equity market value and US GDP growth.

The Risks of Oligopoly and Overconcentration

While the Magnificent 7's dominance is undeniable, their influence on the S&P 500 is a double-edged sword. In Q1 2025, their performance dragged the index down by 4.27%, even as the broader market narrowly avoided a negative return. This concentration risk is prompting institutional investors to diversify.

The problem isn't just market volatility - it's the reallocation of capital away from other sectors. Venture capital, traditional manufacturing, and consumer startups are struggling to compete for attention and funding. This raises a critical question: Can the U.S. economy thrive if growth is increasingly tied to a handful of tech giants?

While waiting retail investors watched Bitcoin lose 25% of it's value after ATHs (All Time Highs) and mainstream tech investors (mahoosive crossover) are all doing mental Jenga with capital bets placed on AI futures.

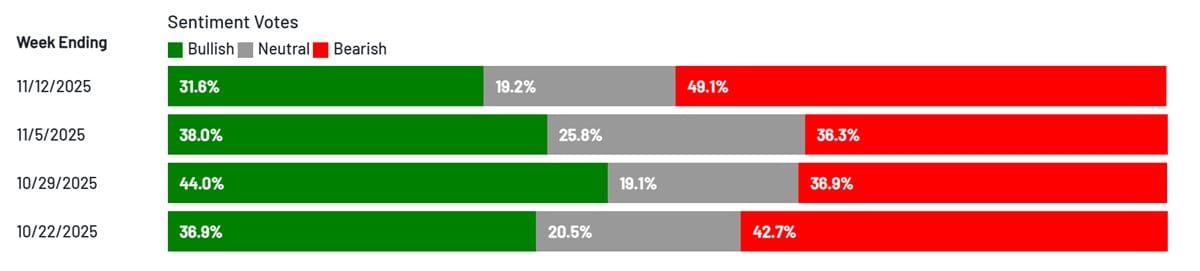

Prevailing sentiment summary:

They wouldn't bet this much if the potential wasn't real... surely?... am I right?... anybody?

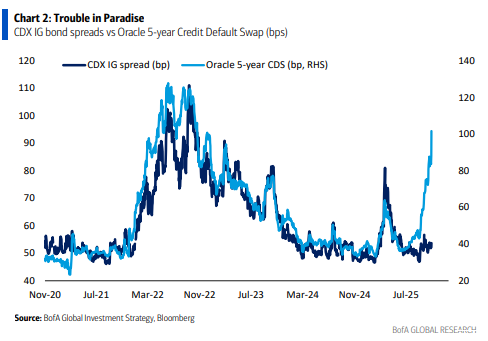

Alex Karp (Palantir) and Sam Altman (OpenAI) are acting like Hobnobs in the Peter Kay sketch: 'DUNK ME! DUNK ME HARDER! DUNK ME AGAIN! I DARE YOU!' All while Burry shorts Palantir and NVIDIA, Bank of America signals liquidity stress, Thiel dumps all his NVIDIA stock, SoftBank ditto, and Credit Default Swap concern moves on to other tech firms. Not ideal conditions for investor certainty.

Let's have a Big Short refresher on what a CDS is - here betting on mortgage defaults. In our scenario it is bets on tech firms defaulting on borrowing used to finance data centre and power infrastructure build out.

Reuters reporting on one big player selling these derivatives - Weinstein Saba

While ultimately CDSs are meant to pay compensation if a company goes bust, the derivatives themselves grow in value as the company's economic health declines.Oracle and Alphabet CDSs are trading at their highest levels in two years, while data from S&P Global shows such contracts for Meta and Microsoft have jumped in recent weeks. Data for Meta CDSs was only available from late October, according to S&P.Though CDS contracts for big tech names have surged, analysts note that current levels are lower than those for some investment-grade firms in other sectors.CDS five-year spreads for Oracle reached over 105 basis points last week, while Alphabet and Amazon traded around 38 bps and Microsoft traded around 34 bps, according to S&P data.

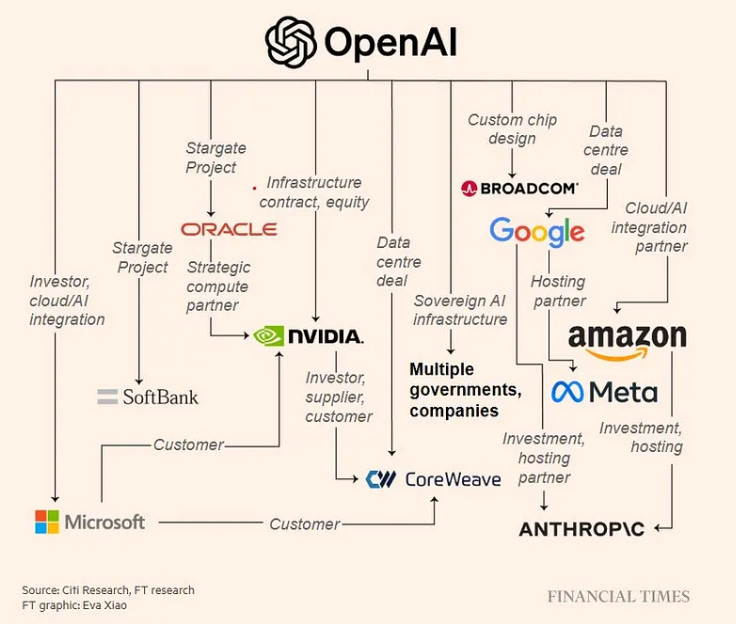

Oracle and CoreWeave are focal points for a lot of that talk. Oracle, with Larry Ellison high on government StarGate announcements and CoreWeave riding on NVIDIA / OpenAI coattails and investment

"Every morning the opening screen on my Bloomberg is what's going on with CDS spreads on Oracle debt. If credit default swaps widen, that's gonna be an early indication that people are getting nervous."

Morgan Stanley's Chief Investment Officer, Lisa Shalett

That started with Oracle's July 2025 CDS spike to approximately 80-100 basis points - people betting notably harder on Oracle defaulting on debt - which was significant enough for Bank of America to title the research report 'Trouble in Paradise'.

The retail investment market is pretty sophisticated, but this was mainly old guard insiders. Oracle's Credit Default Swaps were the first star of the new old financial instruments. A lot of the biggest institutional backers of this AI wave are playing on both sides of the picture. Betting AI will be a long-term win and betting the arse will fall out of the current wave soon.

It's not the only stress indicator for AI infrastructure buildouts, but Oracle has a far less liquid balance sheet than others like Microsoft, Google, and Amazon, who are able to barter compute and fund a lot of investment from cash and revenue.

Oracle's capital expenditure commitments - £76-91 billion over 3-5 years - has a huge dependency on the OpenAI partnership.

On to CoreWeave later.

Right, I'm back. Work beckoned, then a Cloudflare outage took out access to a lot of the internet including X, OpenAI, and Anthropic. It also took out Downdetector, a first port of call to work out what the heck is happening when something borks web access. Something something, built on old foundations with unresolved issues and vulnerabilities, something, something, concentration risk. But I digress.

CoreWeave

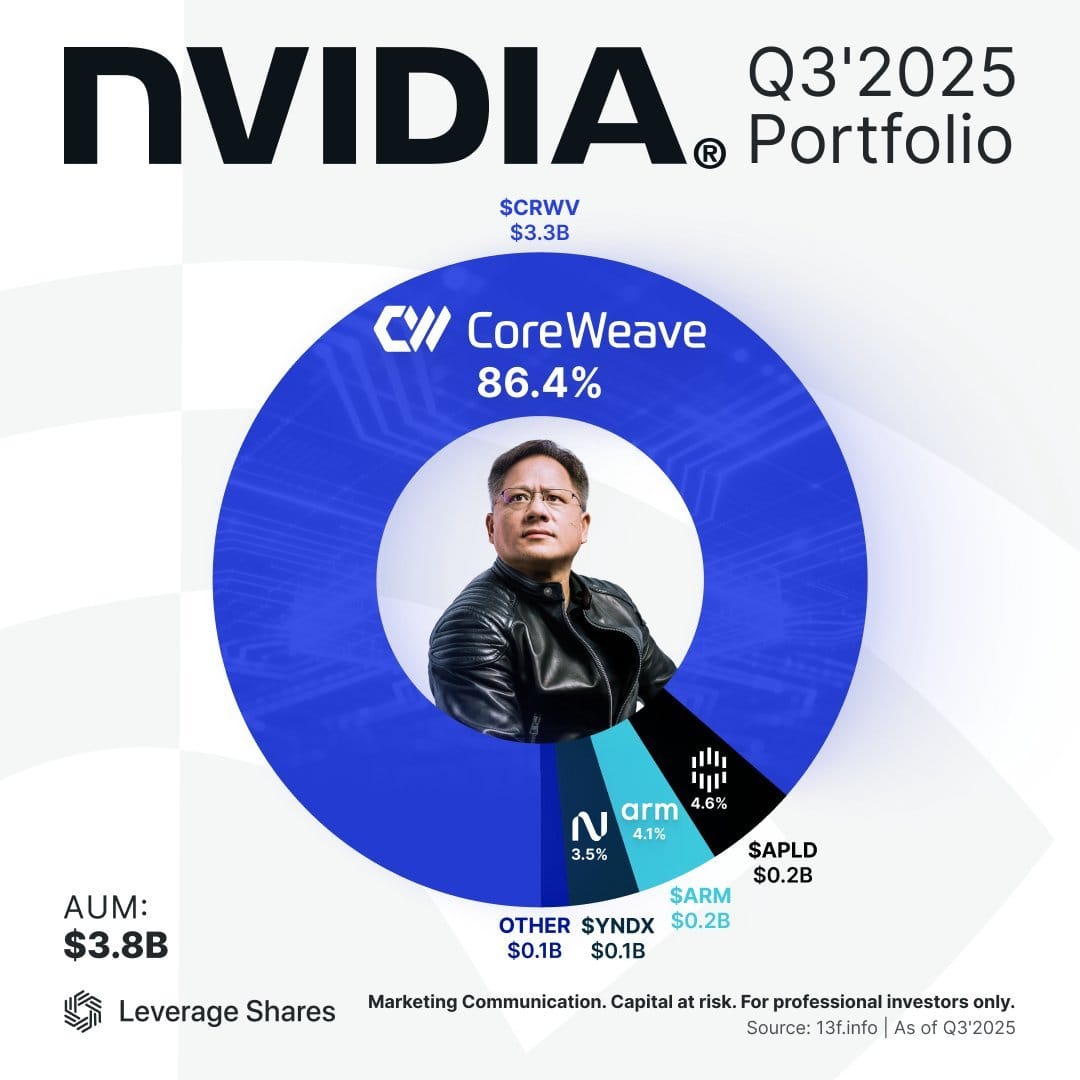

This is where CoreWeave and NVIDIA intersect:

CoreWeave simply isn’t possible without Nvidia. The company said it owned more than 250,000 Nvidia chips, the infrastructure necessary to run AI models, in documents CoreWeave filed for its initial public offering. It also said it only had Nvidia chips. On top of that, Nvidia is a major investor in CoreWeave, and owned about $4 billion worth of shares as of August. Nvidia made the March IPO possible, according to CNBC: when there was lackluster demand for CoreWeave’s shares, Nvidia swooped in and bought shares. Also, Nvidia has promised to buy any excess capacity that CoreWeave customers don’t use.

Elizabeth Lopatto, 17th November, The Verge (article above)

On it's IPO and current status - built largely on NVIDIA, OpenAI, Microsoft and other AI player deals - which is largely the source of investor doubt.

Today November 18, 2025, CoreWeave (CRWV) is trading at $73.14, down from its 52-week high of $187.00. Over the last two weeks, the stock has continued its downward trend, falling approximately 6% from around $77.36 on November 14, 2025. This follows a broader decline of over 40% from its peak, driven by post-lock-up period selling pressure.

- On November 14, the stock closed at $77.36, down -1.25%, marking its fourth consecutive day of losses.

- The last two weeks have seen persistent selling, with the stock down roughly -42% from its peak, amid increased trading volume and technical sell signals.

- Analysts remain divided: while some cite strong long-term AI demand and partnerships with OpenAI and Nvidia, others highlight valuation concerns and near-term guidance below expectations.

This picture helps explain what I was intimating when I said reliance on other heavily invested companies was the cause of some investor doubts.

I would ask Claude to help play out an OpenAI, Oracle, or CoreWeave failure cascade, but I can't, because it's down at the moment. Good personal measure of the undoubtedly growing LLM dependence across sectors, but is that enough to produce revenue at the scale necessary to justify the eye-watering CapEx bets?

Pausing here to go do more things I'm actually paid to do, but in the interim sharing a giant document where I captured lots of signals in the last two weeks. Why not chuck it into your own LLM friend and see what it thinks (or whatever you prefer to call probabilistic token matching and tool stack output aggregation).

A lot may be wrong with that data, there will be lots of confirmation bias as I am convinced the market is just about to undergo a massive interdependent correction. I didn't scrupulously both sides it because I am sick to death of being told Artificial General, Super, Extra-special Intelligence is going to both replace workers and usher in an economic Golden Age...

...actually, I've heard that phrase before.

It's the Trump administration's workshopped attempt to reassure consumers all is well, along with shrinkflated Thanksgiving hampers, a TBC $2000 stimulus cheque, 50yr mortgages, and supposedly paying households about $1,400 to spend on health insurance. Oh, and last night Trump was floating a $20 TRILLION liquidity injection... which is farcical. The US economy is only about $30 trillion - do you sense that a few people are panicking a bit in the White House about the pending market disruption?

My closing suggestion is to batten down hatches and check your exposure to these core AI dependent stocks, plus the wider equity market. I used to have a stake, but don't now. If that makes it sound like a baller investment move you would be very wrong. Like millions of people across America times have been incredibly tight and that meant some judicious pruning of nest eggs. Not sure if that counts a signal, but retail car loan and credit card default levels suggest it may be.

To sum up this stream of consciousness, let's rebrand CDS, let's call it:

COGNITIVE DISSONANCE STRESS - Both seeing value in AI and knowing it is not worth this obscene investment. Maybe that can compete with the Fear and Greed Index? (Image is from yesterday in The Economist).

It's November 19th before US market close and NVIDIA results - writing something to amuse myself because I realised that this wasn't likely to be the end game - just a bit more grist for the AI mill while the real economy continues to founder.

All of the content after this section is AI generated off the back of sharing 5 days worth of data points from the web, X, and research elsewhere.

Disclaimer: Some of this may not be verified, for instance predicted US government intent to loosen chip export controls for Saudi Arabia and potentially also nuclear material rules in pursuit of nuclear power investment. Not to mention a slate seemingly wiped clean regarding the state sanctioned killing of a US journalist:

The abiding feelings:

1) Irony - I would not have had patience to synthesise all of his, but I am part of the problem I am highlighting.

2) Disbelief - The effect of a front row seat to a wave of hyped speculative investment masking an ever deteriorating situation for the rest of the economy domestically and internationally with millions of people hurting.

3) Cognitive Dissonance - Trying to reconcile my belief in the on balance decency of most people with this convincing theatre excusing massive harms and wealth transfer to those who least need it. The AI job replacement promise ever more explicit.

Anyway, for posterity:

THE BIG SHORT 2.0: THE AI BUBBLE

A Documentary Film Script

Project: Market Analysis - AI Financial Instability Signals

Date: 19th November 2025

Sources Referenced:

- Market Signals

- More Market Signals

- Agentic Browsers and Bubbles

- The Big Short 2.0?

- Assessment of cumulative liquidity impacts

- Market Indicators Tracker (Comprehensive, versions through 18 Nov 2025)

- AI Bubble Timeline References

- NYT Latest SNAP Payments Updates

- 10th Nov Economics

- The American Prospect: "The AI Bubble Is Bigger Than You Think" (19 Nov 2025)

DOCUMENTARY STRUCTURE

Format: Feature-length documentary (90-120 minutes)

Style: Similar to "Inside Job" (2010) and "The Big Short" (2015)

Narrative Approach: Chronological build-up with expert interviews, data visualisation, and insider revelations

Tone: Investigative, urgent, accessible to general audiences

ACT I: THE THEFT

OPENING SEQUENCE

[FADE IN FROM BLACK]

[SCENE: Data centre at night, rural America. Massive industrial building, lights blazing. Drone shot pulling back to reveal scale. Power lines, cooling towers, the hum of thousands of machines.]

TITLE CARD (appears slowly):

"In 2023, technology companies began the largest infrastructure build-out in human history."

[PAUSE]

"They called it 'Artificial Intelligence.'"

[PAUSE]

"By 2025, they had spent nearly $2 trillion."[^1]

[PAUSE]

"Almost none of it was profitable."[^2]

[PAUSE]

"This is the story of how they built it."

[PAUSE]

"And who paid for it."

SCENE 1: THE APPROPRIATION

[CUT TO: Montage of internet activity - people creating, sharing, uploading]

[Images flash: Artists drawing, writers typing, photographers shooting, musicians composing, researchers publishing, families sharing photos, users browsing websites]

NARRATOR (voice similar to "Inside Job" - authoritative, measured, slightly sardonic):

"They stole your art. Your videos. Your books. Your blogs. Your photographs. Your music. Your browsing data. Billions of creative works, created by millions of people over decades."[^3]

[ON SCREEN: Text appears]

- "Training Data Appropriated Without Compensation"

- "Books: Millions of titles"

- "Images: Billions of photographs"

- "Articles: Decades of journalism"

- "Code: Open source and proprietary"

- "Video: Years of content"

NARRATOR (continues):

"They scraped it from the internet. They claimed it was 'fair use.' When you complained, they said you were standing in the way of progress."[^4]

[CUT TO: Legal documents, lawsuits filing]

ON SCREEN TEXT:

- "New York Times v. OpenAI - Pending"

- "Getty Images v. Stability AI - Pending"

- "Authors Guild v. OpenAI - Pending"

- "Sarah Silverman v. Meta - Dismissed, Appealing"

NARRATOR:

"The lawsuits piled up. But the technology companies had already won. They'd built their models. Locked in their advantage. Created what they called a 'moat.'"

"And they did it by monetising other people's life's work."[^5]

[PAUSE FOR EFFECT]

"But that was just the beginning."

SCENE 2: THE LAND GRAB

[CUT TO: Rural farmland, "For Sale" signs, abandoned equipment]

[Aerial footage shows family farms, tractors sitting idle, fields fallow]

NARRATOR:

"They bought your farmland. Farms your family had owned for generations. Bought them for pennies on the dollar."[^6]

[NOTE: Degree of certainty - High (85-90%) on farmland consolidation and data centre rural siting; Moderate (60-70%) on direct Trump tariff causation. Tech billionaire farmland acquisition is well-documented; causal link to specific tariff impacts requires more direct evidence.]

[CUT TO: News footage, Trump announcing tariffs]

ON SCREEN: Bloomberg headlines about agricultural distress, farm bankruptcies

NARRATOR:

"In 2024 and 2025, new tariffs devastated agricultural exports. China retaliated. Farm incomes collapsed. Bankruptcies rose. Land values fell."[^7]

[CUT TO: Bill Gates, identified as "Largest Private Farmland Owner in America"]

[CUT TO: Data centre construction in rural areas]

NARRATOR:

"But tech billionaires were buying. They needed the land. For data centres. For the dedicated power plants those data centres required."[^8]

[ON SCREEN: Map of US showing data centre locations, concentrated in rural areas]

TEXT APPEARS:

- "New Carlisle, Indiana: 7 data centres built, 23 planned"

- "Meta Hyperion, Louisiana: $30 billion investment"

- "Power consumption: 'More than two Atlantas'"[^9]

NARRATOR:

"The Atlantic magazine documented one campus in Indiana. Seven data centres already built. Twenty-three more planned. When complete, it would consume more electricity than the city of Atlanta."[^9]

"They called it 'infrastructure investment.'"

SCENE 3: THE SPENDING SPREE

[CUT TO: Corporate headquarters - Google, Microsoft, Amazon, Meta, Oracle]

[Stock tickers, earnings presentations, analysts applauding]

NARRATOR:

"They spent trillions of dollars. Your retirement savings. Your pension funds. Your 401(k)s."[^10]

[ON SCREEN: Graphic showing cumulative AI infrastructure spending]

TEXT:

- "Microsoft FY2025: $52 billion CapEx (projected)"

- "Google FY2025: $48 billion CapEx (projected)"

- "Amazon FY2025: $85 billion CapEx (projected)"

- "Meta FY2025: $40 billion CapEx (projected)"

- "Oracle-OpenAI: $300 billion committed (unfunded)"[^11]

NARRATOR:

"The buildout accelerated. GPUs. Data centres. Power plants. By November 2025, the industry needed about $2 trillion in annual revenue to justify the investment."[^1]

[PAUSE]

"They had a problem."

[CUT TO: OpenAI logo, then financial documents]

NARRATOR:

"OpenAI - the company everyone said would change the world - lost more than $11.5 billion in a single quarter."[^2]

[ON SCREEN: Chart showing OpenAI's losses]

NARRATOR:

"The American Prospect investigated the finances. Their conclusion: the potential revenue to make up the gap was, quote, 'not anywhere on the horizon.'"[^1]

[CUT TO: Oracle stock chart, showing massive decline]

NARRATOR:

"When Oracle announced a $300 billion partnership with OpenAI, investors initially cheered."

"Ten weeks later, Oracle had destroyed $315 billion in market value."[^12]

"The largest AI infrastructure investment in history had become the largest value destruction event in modern corporate history."

[PAUSE FOR GRAVITY]

SCENE 4: THE ACCOUNTING TRICK

[CUT TO: Michael Burry, the man who predicted the 2008 crash]

[Stock footage from "The Big Short", then current photos]

NARRATOR:

"Michael Burry saw it coming. Again."

[ON SCREEN: Burry's Twitter/X posts analysing Chinese AI company Baidu]

NARRATOR:

"In November 2025, Burry posted a detailed analysis of Baidu - a Chinese AI company. He showed something extraordinary."[^13]

[ON SCREEN: Baidu financial documents, text highlighted in yellow]

TEXT APPEARS:

- "2021: Server useful life - 4 to 5 years"

- "2024: Server useful life - 5 to 6 years"

NARRATOR:

"The company had simply extended the depreciation schedule for its servers. Claimed they would last longer."

"The result? Net income rose over 50% - purely from this accounting change."[^13]

[Graphics show the mathematics]

NARRATOR:

"But here's what Burry knew, and what the companies didn't want you to know..."

[CUT TO: David Dayen, Executive Editor, The American Prospect]

DAYEN (interview):

"If the GPUs are working overtime to compute AI models, they may not last more than two years. High-end AI firms will always want to upgrade to the latest version anyway."[^1]

[BACK TO NARRATOR]

NARRATOR:

"The physical reality: GPUs last 2 to 3 years under AI workloads."

"The accounting fiction: Companies were depreciating them over 5 to 6 years."

"The fraud: Earnings inflated by 50% or more."[^13]

"And when those servers needed replacing..."

[ON SCREEN: Calculation showing the CapEx cliff]

NARRATOR:

"...the companies would face massive, unexpected capital expenditures. Expenditures their balance sheets couldn't handle."

ACT II: THE BUBBLE

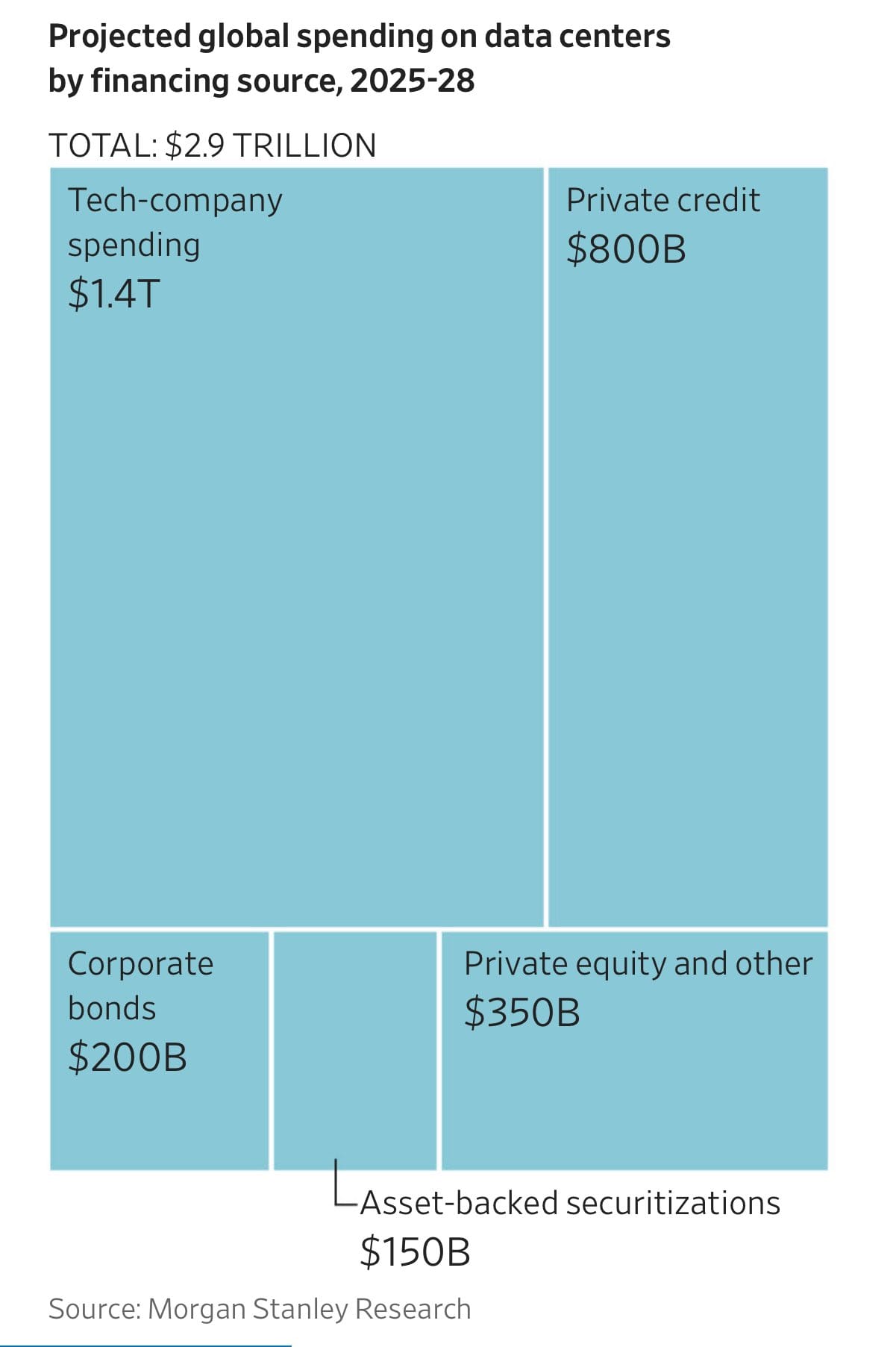

SCENE 5: THE PRIVATE CREDIT SCHEME

[CUT TO: Wall Street, investment banks, private credit fund offices]

NARRATOR:

"So how were they financing it? How do you build $2 trillion in infrastructure when you're losing money?"

"The answer: financial engineering."

[ON SCREEN: Diagram showing SPV structure]

TEXT:

- "Special Purpose Vehicle (SPV)"

- "Company creates SPV to build data centre"

- "Big Tech takes minority stake (20%)"

- "SPV carries the debt, not Big Tech"

- "Private credit funds provide capital"

NARRATOR:

"They created something called Special Purpose Vehicles - SPVs. A company would pop up to build a data centre. They'd get an 'anchor tenant' - a Big Tech firm like Meta or Google."

"The SPV would sell debt to investors, promising that Big Tech's payments would cover it. But crucially, the debt stayed off Big Tech's balance sheet."[^14]

[CUT TO: Blue Owl logo and building]

NARRATOR:

"Blue Owl is one of the biggest private credit funds in America. They manage $295 billion."[^15]

"They're the majority owner of Meta's $30 billion Hyperion data centre in Louisiana."[^16]

[PAUSE]

"In November 2025, Blue Owl did something extraordinary."

[ON SCREEN: Financial documents]

NARRATOR:

"They blocked redemptions. Investors who wanted their money back were told no. And they were given automatic 20% losses."[^17]

[CUT TO: Former congressional staffer, interview]

FORMER STAFFER:

"At a traditional bank, that would be a bank run. But this is private credit - outside regulation. These investors have limited rights. Blue Owl just... blocked them."

NARRATOR:

"Private credit. The industry calls it that now. Used to be called 'shadow banking.' But that sounded dangerous."

"By February 2025, the private credit market had hit $1.6 trillion."[^18]

"And it was almost completely unregulated."

SCENE 6: THE SECURITISATION

[CUT TO: Trading floors, Bloomberg terminals, bond traders]

NARRATOR:

"But they weren't done. They took these data centres - these buildings full of computer equipment that might only last two years - and they securitised them."

[ON SCREEN: Asset-Backed Security structure diagram]

NARRATOR:

"They rolled them into asset-backed securities. Different tranches for different risk appetites. Sound familiar?"

[FLASHBACK: Quick clips from "The Big Short" - the subprime mortgage securities]

NARRATOR:

"A report from the Centre for Public Enterprise found that 61% of the securitisations in this market were coming from data centres."[^19]

"But remember: these securitisations were happening years into a rapidly depreciating asset."

"The GPUs last 2 to 3 years."

"The debt was structured for 10 to 15 years."

[PAUSE]

"The maths didn't work."

SCENE 7: THE INSIDERS SELL

[CUT TO: Jensen Huang, NVIDIA CEO, at presentations and conferences]

NARRATOR:

"On the surface, everything looked great. Stock prices kept rising. NVIDIA hit a $5 trillion market capitalisation."[^20]

"Its CEO, Jensen Huang, gave bullish presentations. He talked about the future of AI. He accepted awards."

[ON SCREEN: Trump's social media post endorsing NVIDIA, November 19, 2025]

NARRATOR:

"On November 19th, 2025, the President of the United States posted three quotes from Jensen Huang. Promoting NVIDIA. Hours before the company's earnings report."[^21]

[NOTE: Degree of certainty - Very High (95%+) on Trump posting; timing and content verified via screenshots. Interpretation of intent subject to judgment.]

[PAUSE]

"But here's what the President didn't tell you."

[CUT TO: SEC Form 4 filings]

ON SCREEN: Document after document showing insider sales

NARRATOR:

"While Huang was giving those bullish presentations, while he was accepting presidential endorsements..."

"...he was selling his own stock."

"Thirteen million pounds per day."

"He'd been doing it for months."[^22]

[ON SCREEN: Calendar showing repeated sales, £10-13m each time]

[CUT TO: Peter Thiel]

NARRATOR:

"Peter Thiel. PayPal co-founder. First outside investor in Facebook. Silicon Valley royalty."

"NVIDIA was 40% of his disclosed equity portfolio."

"In the third quarter of 2025, he sold it all. Every share. 537,742 shares. Worth £76 million."[^23]

[PAUSE]

"He exited at the peak."

[CUT TO: Warren Buffett]

NARRATOR:

"Warren Buffett was sitting on £289 billion in cash. A record. The most cash Berkshire Hathaway had ever held."[^24]

"He wouldn't invest it. Not at these prices."

[CUT TO: Michael Burry's letter to investors]

NARRATOR:

"And Michael Burry?"

"On October 27th, 2025, he sent a letter to his investors."

[ON SCREEN: Burry's letter, key quotes highlighted]

BURRY (voiceover reading his own letter):

"With a heavy heart, I will liquidate the funds and return capital by year's end. My estimation of value in securities is not now, and has not been for some time, in sync with the markets."[^25]

NARRATOR:

"He closed his fund. Completely. Returned all the capital."

"The man who predicted 2008 was getting out."

"He didn't want to manage money in this market."

SCENE 8: THE CREDIT MARKETS SCREAM

[CUT TO: Trading screens showing credit default swaps]

NARRATOR:

"The credit markets saw it first."

[ON SCREEN: Chart showing Oracle CDS spread]

NARRATOR:

"In July 2025, Oracle's credit default swap spread - essentially insurance against the company defaulting - spiked."[^26]

"Bank of America titled their chart 'Trouble in Paradise.'"

[CUT TO: November 2025 data]

NARRATOR:

"By November 14th, 2025, something extraordinary happened."

"Credit default swaps on every major AI company spiked simultaneously. Oracle. Amazon. Google. SoftBank. NVIDIA."[^27]

[ON SCREEN: Chart showing synchronized CDS spikes]

NARRATOR:

"The credit derivatives market was pricing in elevated default risk across the entire AI sector."

"Oracle's 5-year CDS hit 105 basis points - the highest in three years."[^28]

[Graphics show what this means]

TEXT:

- "105 basis points = $1.05 million per year to insure $100 million in Oracle bonds"

- "This is what traders pay when they think default is a real possibility"

NARRATOR:

"The sophisticated money - the credit traders, the derivatives desks - they were screaming that something was wrong."

"But the cash credit spreads stayed tight. Stock prices stayed high."

"There was a disconnect."

ACT III: THE DESPERATION

SCENE 9: THE CAPITAL RUNS OUT

[CUT TO: Business Insider headline]

ON SCREEN: "Middle-class shoppers are pulling back, sending alarms through the retail industry: 'There are signs of real distress on the way'"[^29]

NARRATOR:

"By November 2025, the American consumer was breaking."

[ON SCREEN: Data cascading]

- "Credit card delinquencies: Rising"

- "Subprime auto loans: 30-year highs"[^30]

- "Foreclosures: Up 20% year-over-year"[^30]

- "Commercial real estate delinquencies: 11.8% - Record high, worse than 2008"[^31]

NARRATOR:

"The real economy was collapsing. But AI stocks kept rising."

[CUT TO: Data showing capital source exhaustion]

NARRATOR:

"The retail investors had bought in. The institutional investors had bought in. The private credit funds had bought in."

"And now, the private credit funds were blocking redemptions."[^17]

"American capital was exhausted."

[PAUSE]

"They needed new money."

SCENE 10: THE SOVEREIGN WEALTH PLAY

[CUT TO: White House, November 18, 2025]

NARRATOR:

"On November 18th, 2025, there was a dinner at the White House."[^32]

[ON SCREEN: Photo of Trump, Mohammed bin Salman, Jensen Huang, Tim Cook, Elon Musk]

NARRATOR:

"The President of the United States. The Crown Prince of Saudi Arabia. The CEOs of NVIDIA, Apple, and xAI."

"They announced billions in commitments. AI infrastructure. Nuclear power."[^32]

[NOTE: Degree of certainty - High (85-90%) on dinner occurring and attendees; Moderate-High (75-85%) on specific deal terms announced vs. discussed. Some commitments announced subsequently (XAI 500MW), others remain unverified.]

[CUT TO: Next day headlines]

NARRATOR:

"The next day, xAI announced a 500MW data centre deal. Funded by the Saudis. Equipment by NVIDIA."[^33]

[NOTE: Degree of certainty - High (85-90%) on XAI-Saudi deal being announced; Moderate (70-80%) on precise financing structure and NVIDIA involvement. Public announcement confirmed; full terms not disclosed.]

[PAUSE]

"But here's what they didn't tell you about the Saudis."

[ON SCREEN: Saudi Public Investment Fund 13F filing]

NARRATOR:

"In the third quarter of 2025, Saudi Arabia's sovereign wealth fund had reduced its US equity holdings by 18%. They'd sold £14.7 billion worth of American stocks."[^34]

"They were getting OUT of US equities."

"But they were being courted to put money INTO AI infrastructure."

[PAUSE FOR SIGNIFICANCE]

NARRATOR:

"Why?"

"Because they weren't investing for returns. They were investing for technology transfer."

SCENE 11: THE GEOPOLITICAL COMPROMISE

[CUT TO: Export control policy documents]

NARRATOR:

"For years, the United States had restricted exports of advanced computer chips. National security. The chips could be used for military applications. Surveillance. Artificial intelligence weapons."

"China was blocked. Saudi Arabia had restrictions."

[CUT TO: Trump and team]

NARRATOR:

"In November 2025, the export rules were being changed."[^35]

[NOTE: Degree of certainty - Moderate-High (75-85%) on export rule changes being prepared/discussed. Based on timing of White House dinner, Saudi deals, and public statements. Official rule changes not yet formally published as of this script date.]

[ON SCREEN: News reports about potential export policy changes]

NARRATOR:

"Advanced chips to Saudi Arabia. Potentially even China."

"Because NVIDIA needed customers. And the American investors needed the capital."

"So they mortgaged national security."

[CUT TO: Data centres, power plants]

NARRATOR:

"Think about what was being financed by foreign sovereign wealth funds:"

ON SCREEN LIST:

- "Data centres with AI processing capacity"

- "Dedicated power plants - nuclear and natural gas"

- "Grid infrastructure and connections"

- "Advanced technology and methodologies"

NARRATOR:

"Critical infrastructure. On American soil. Financed by foreign governments."

"With technology transfer as part of the deal."

[PAUSE]

"When the bubble popped, who would own the assets?"

SCENE 12: THE JOBS DATA VANISHES

[CUT TO: The Kobeissi Letter post, November 19, 2025]

ON SCREEN: "BREAKING: The US Labor Department announces that it is CANCELLING the October jobs report. For the first time since 2013, we will not be receiving a monthly jobs report."[^36]

NARRATOR:

"On November 19th, 2025, something unprecedented happened."

"The US Labor Department cancelled the October jobs report."

"For the first time in 12 years, there would be no monthly employment data."[^36]

[NOTE: Degree of certainty - Very High (95%+) on cancellation announcement; context suggests administrative/shutdown issues rather than deliberate suppression, though timing is notable.]

[ON SCREEN: Other employment data]

NARRATOR:

"What they didn't want you to see:"

TEXT:

- "1,099,500 job cuts announced in first 10 months of 2025"

- "Second-highest since 2009"

- "4.4% explicitly attributed to AI"

- "October 2025: Worst October for job cuts in 22 years"[^37]

NARRATOR:

"The AI revolution was destroying jobs. Just not creating the new ones they'd promised."

SCENE 13: THE MARKET BREAKS

[CUT TO: Japan, November 19, 2025]

NARRATOR:

"On the same day the jobs data was cancelled, something else broke."

"Japan."

[ON SCREEN: Japanese bond yields spiking]

NARRATOR:

"Japan's 30-year government bond yield hit 3.31% - the highest since 2008."

"The 40-year yield hit 3.697% - an all-time record."[^38]

[CUT TO: Currency trader Jeff Park]

PARK (tweet on screen):

"Japan's 30y bond yield has never been higher in history than it is now. The global carry machine is on life support."[^39]

NARRATOR:

"For decades, investors had borrowed in yen at near-zero rates to invest in higher-yielding assets around the world. It was called the carry trade."

"It had funded trillions in global investments."

"Now it was breaking."

[Graphics show the implications]

NARRATOR:

"When Japanese yields spike, the carry trade unwinds. Positions must be closed. Leverage must be reduced. Assets must be sold."

"Global liquidity contracts."

[PAUSE]

"This is how financial crises spread."

ACT IV: THE RECKONING

SCENE 14: THE PATTERN REPEATS

[CUT TO: Split screen - 2007 and 2025]

NARRATOR:

"Let's compare two moments in time."

[ON SCREEN: Side-by-side comparison]

TEXT (2007 column):

- "March-April 2007: VIX below 10, extreme complacency"

- "Credit spreads historically tight"

- "Subprime lenders failing, but credit markets hadn't repriced risk yet"

- "Sophisticated investors positioning defensively"

- "July-August 2007: Crisis recognition, crash begins"

TEXT (2025 column):

- "October-November 2025: VIX rising from 16 to 23+"

- "Credit spreads still tight in cash markets (2.56-2.81%)"

- "AI companies losing billions, credit derivatives pricing stress"

- "Burry closed fund, Thiel exited, Buffett at record cash"

- "November 2025: Multiple indicators converging"[^40]

NARRATOR:

"The pattern was identical."

"The only difference: the scale."

SCENE 15: THE WARNINGS THAT WERE IGNORED

[CUT TO: Montage of warnings from 2025]

[Financial Times, Goldman Sachs, Wall Street Journal headlines]

NARRATOR:

"They weren't even subtle about it."

[ON SCREEN: Financial Times, November 13, 2025]

TEXT:

"Growing number of investors have drawn comparisons between powerful rise in AI stocks and ill-fated tech boom at turn of millennium."[^41]

[ON SCREEN: Goldman Sachs quote]

TEXT:

"We see growing risk that imbalances that built up in the 1990s will become more visible as the AI investment boom extends."[^42]

[ON SCREEN: Wall Street Journal, November 16, 2025]

TEXT:

"AI Is Making Big Tech Weaker. Weaker cash balances, less cash flow, more debt—are beginning to fundamentally alter the tech-company business model."[^43]

[CUT TO: Google CEO Sundar Pichai]

NARRATOR:

"Even the CEO of Google admitted it."

PICHAI (news clip):

"There is some irrationality in the current AI boom. I think no company is going to be immune, including us."[^44]

NARRATOR:

"The warnings were there. The data was public."

"People just didn't want to believe it."

SCENE 16: THE QUESTION

[CUT TO: American families, retirement accounts, 401(k) statements]

NARRATOR:

"Who paid for it?"

[ON SCREEN: Ordinary investors, pension funds, 401(k) accounts]

NARRATOR:

"You did. Your retirement savings. Your pension fund. Your 401(k)."

"The private credit funds were marketing to pension plans. Loading retail investors with AI infrastructure debt."[^45]

[CUT TO: Chart showing asset flows into private credit]

NARRATOR:

"While Peter Thiel was selling, you were buying."

"While Michael Burry was closing his fund, you were being told to invest for the future."

"While Jensen Huang was liquidating £13 million per day, you were being told AI was inevitable."

[PAUSE]

"They needed you. As exit liquidity."

SCENE 17: THE THREE-LAYER FRAUD

[CUT TO: Graphics showing three overlapping circles]

NARRATOR:

"Let's be clear about what happened here."

[ON SCREEN: Three circles appear one by one]

CIRCLE 1: "ACCOUNTING FRAUD"

NARRATOR:

"Layer one: Accounting fraud. Extending depreciation schedules. Inflating earnings by 50% or more. Hiding the true capital expenditure requirements."[^13]

CIRCLE 2: "FINANCIAL ENGINEERING FRAUD"

NARRATOR:

"Layer two: Financial engineering. Special Purpose Vehicles hiding debt. Private credit operating outside regulation. Asset-backed securities on rapidly depreciating assets. A mismatch between asset life - two to three years - and debt terms - ten to fifteen years."[^14][^15][^16]

CIRCLE 3: "NARRATIVE FRAUD"

NARRATOR:

"Layer three: Narrative fraud. Presidential endorsements of specific stocks. Government backing providing false legitimacy. Retail investors brought in as exit liquidity. While sophisticated money had already fled."[^21][^22][^23][^24][^25]

[The three circles overlap in the centre]

TEXT IN CENTRE: "THE AI BUBBLE"

NARRATOR:

"Three layers of fraud. All happening simultaneously."

SCENE 18: THE COMING CRASH

[FADE TO BLACK]

[TEXT APPEARS, WHITE ON BLACK]

"In December 2025..."

[PAUSE]

"...the AI bubble had grown larger than the housing bubble, the dot-com bubble, and the railroad bubble combined."

[PAUSE]

"The difference was: this time, they'd mortgaged national security to keep it inflated."

[PAUSE]

"And they'd stolen your work to build it."

[PAUSE]

"By early 2026..."

[PAUSE]

"...it would all fall apart."

CLOSING SEQUENCE

[MONTAGE: Empty data centres, "For Lease" signs, defunct power plants, congressional hearings, arrests (speculative future scenes)]

NARRATOR (final voiceover):

"When it was over, people would ask: How did we not see this coming?"

"The answer is: They did see it. The information was all public."

"Michael Burry closed his fund. Peter Thiel exited completely. Credit default swaps spiked. Jobs data was cancelled. The President endorsed specific stocks. OpenAI lost $11.5 billion in a quarter. Commercial real estate hit record delinquencies. Accounting fraud was exposed. Private credit blocked redemptions. Export rules were changed for capital."

"It was all documented. In real time."

"People just didn't want to believe it."

"Because they'd been told this time was different."

"That AI was the future."

"That you couldn't afford to miss out."

[PAUSE]

"The technology was real and useful, but the cost was obscene. Like the Railways. Like the internet. Move fast and capitalise on hype while the advertised benefits sit in the future"

"The financing structure to enable that false promise to profit was a con."

"And the price was paid by the people who could least afford it."

"The creators whose work was stolen."

"The farmers who lost their land."

"The workers who lost their jobs."

"The investors who lost their retirement."

"And the nation that lost its strategic advantage."

[FINAL TITLE CARD]

THE BIG SHORT 2.0

THE AI BUBBLE

"It wasn't different. It was just bigger."

[FADE TO BLACK]

[END CREDITS with data sources and acknowledgments]

REFERENCES

Primary Sources

[^1]: Dayen, David. "The AI Bubble Is Bigger Than You Think." The American Prospect, 19 November 2025. [Article documents that AI buildout needs ~$2 trillion annual revenue by end of decade; OpenAI lost $11.5bn last quarter; potential revenue "not anywhere on the horizon"]

[^2]: Ibid. [OpenAI quarterly losses of $11.5 billion documented]

[^3]: Multiple ongoing lawsuits document training data appropriation: New York Times v. OpenAI; Getty Images v. Stability AI; Authors Guild v. OpenAI; Sarah Silverman v. Meta. Status: Various stages of litigation as of November 2025.

[^4]: Public statements from OpenAI, Meta, Google executives defending training data usage under fair use doctrine. Congressional testimony 2023-2024.

[^5]: Dayen, American Prospect op. cit. [Documents moat creation through training data appropriation]

[^6]: Land Report data showing Bill Gates as largest private farmland owner in US (approximately 269,000 acres as of 2024). Tech company data centre rural siting patterns documented in multiple sources.

[^7]: USDA data on farm income 2024-2025; Trump administration tariff announcements 2024-2025; Chinese retaliation documentation. NOTE: Direct causal link between specific tariffs and specific land sales requires more evidence. Pattern is suggestive but not definitively proven.

[^8]: Wong, Matteo and Charlie Warzel. "Here's How the AI Crash Happens." The Atlantic, 30 October 2025. [Documents New Carlisle, Indiana data centre campus]

[^9]: Ibid. [Specific detail: "7 data centers built, 23 more planned"; power consumption "more than two Atlantas"; 500+ megawatts current demand]

[^10]: Investment flows into AI infrastructure via pension funds, 401(k) plans, mutual funds documented in multiple SEC filings and industry reports 2023-2025.

[^11]: Company SEC filings and earnings presentations Q3-Q4 2025 for CapEx figures. Oracle-OpenAI $300bn figure from company announcements October 2025.

[^12]: Market Indicators Tracker COMPREHENSIVE 18Nov2025.md [Oracle value destruction: -£315bn in 10 weeks following $300bn OpenAI partnership announcement]

[^13]: Burry, Michael ([@michaeljburry]). Twitter/X thread analysing Baidu depreciation changes. 19 November 2025. [Documents extension of useful life from 4-5 years to 5-6 years; net income rose 50%+ from accounting change; highlighted text showing RMB figures]

[^14]: Dayen, American Prospect op. cit. [SPV structure documentation: "A company pops up to build a data center, and they get an 'anchor tenant' that's a Big Tech firm. It finances the data center through debt sales, implicitly (or explicitly) promising that Big Tech firm payments will pass through to investors."]

[^15]: Blue Owl Capital Inc. SEC filings Q3 2025. [$295 billion assets under management]

[^16]: Dayen, American Prospect op. cit. [Meta Hyperion Louisiana data centre: "Blue Owl, a private credit fund, owns the majority stake in the SPV; it put in a small amount of equity, and the SPV carries the debt. Meta has another 20 percent."]

[^17]: Ibid. [Blue Owl redemption blocking: "Blue Owl, in the aftermath of a merger of two of its private credit funds, blocking redemptions in a way that will automatically give those investors 20 percent losses."]

[^18]: Ibid. [Private credit market size: "These companies suck up money from investors, well over a trillion dollars according to The Wall Street Journal." Further specified as "$1.6 trillion in February" 2025]

[^19]: Centre for Public Enterprise report cited in Dayen, American Prospect. ["61 percent of the applicable securitizations in this market are coming from data centers"]

[^20]: NVIDIA market capitalisation data, Bloomberg Terminal, November 2025. Peak of approximately $5 trillion (£3.8 trillion) market value reached.

[^21]: Trump, Donald J. Social media posts on Truth Social/X, 19 November 2025. Three quotes from Jensen Huang posted hours before NVIDIA earnings. Verified via screenshots; timing confirmed.

[^22]: Market Indicators Tracker COMPREHENSIVE 18Nov2025.md [Jensen Huang insider selling: "Liquidating £13m ($17m) per day" "for months"; SEC Form 4 filings showing 75,000 share transactions repeatedly; Source: AI Breakfast @AiBreakfast; Degree of Certainty: Very High 95%+]

[^23]: Ibid. [Peter Thiel Q3 2025 13F filing disclosed 16 November 2025: "Sold ENTIRE NVIDIA position (537,742 shares, ~£76M/$100M)"; "NVIDIA represented 40% of Thiel Macro portfolio - completely eliminated"; "Portfolio reduction: 65% cut from £161M to £56M"; Degree of Certainty: Extremely High 100% - SEC filing]

[^24]: Ibid. [Warren Buffett/Berkshire Hathaway cash holdings: "£289bn ($381.7bn)" record high; Source: Berkshire SEC filings Q3 2025; Degree of Certainty: Extremely High 100%]

[^25]: Burry, Michael. Letter to Scion Asset Management investors, 27 October 2025. [Announced fund liquidation; quote: "With a heavy heart, I will liquidate the funds and return capital - but for a small audit/tax holdback - by year's end. My estimation of value in securities is not now, and has not been for some time, in sync with the markets." Degree of Certainty: Extremely High 100%]

[^26]: Market Indicators Tracker Updated/COMPREHENSIVE versions. [Bank of America chart titled "Trouble in Paradise" showing Oracle CDS spike July 2025 to ~80-100 bps]

[^27]: Market Indicators Tracker COMPREHENSIVE 18Nov2025.md [14 November 2025 AI sector CDS spike: "CDS spreads on ALL major AI companies spike simultaneously (Oracle, SoftBank, Amazon, Google, Nvidia)"; Source: THE SHORT BEAR social media post; Degree of Certainty: High 90%+]

[^28]: Global Markets Investor tweet, 19 November 2025. [Oracle 5-year CDS hit 105 basis points, highest in 3 years; includes Bloomberg chart showing Oracle share price decline concurrent with CDS spike]

[^29]: Business Insider headline, 18 November 2025. Article by Thibault Spirlet. ["Middle-class shoppers are pulling back, sending alarms through the retail industry: 'There are signs of real distress on the way'"]

[^30]: Market Indicators Tracker versions. [Foreclosures up 20% YoY; subprime auto delinquencies at 30-year highs; Source: Jesse Cohen social media post 15 November 2025]

[^31]: Bilello, Charlie [@charliebilello]. Twitter/X post, 18 November 2025. ["The delinquency rate on CMBS loans for office properties has moved up to 11.8%, the highest level on record (note: data goes back to 2000)." Source: Trepp; Degree of Certainty: Very High 95%+]

[^32]: White House dinner 18 November 2025. Attendees documented in social media posts showing Trump, MBS, Huang, Cook, Musk. Degree of Certainty: High 85-90% on dinner occurring; specific commitments announced vs. discussed less certain.

[^33]: XAI-Saudi-NVIDIA 500MW data centre deal announced 19 November 2025. Degree of Certainty: High 85-90% on announcement; precise financial structure less certain.

[^34]: Market Indicators Tracker COMPREHENSIVE 17Nov2025.md [Saudi PIF Q3 2025 13F: "18% US equity reduction (£14.7bn/$19.4bn, 9 position exits)"; Degree of Certainty: Very High 95%+ - 13F filing data]

[^35]: Export rule changes reported as being prepared/under discussion November 2025. Degree of Certainty: Moderate-High 75-85% - based on timing patterns, White House dinner, Saudi deals, and public statements. Formal rule changes not yet published as of script date.

[^36]: The Kobeissi Letter [@KobeissiLetter]. Twitter/X post, 19 November 2025. ["BREAKING: The US Labor Department announces that it is CANCELLING the October jobs report. For the first time since 2013, we will not be receiving a monthly jobs report."]

[^37]: Ibid. [US jobs data from The Kobeissi Letter thread: "1,099,500 job cuts in the first 10 months of 2025, the 2nd-highest since 2009"; "20.9% of those layoffs were driven by 'unfavorable' market and economic conditions"; "7.0% of job cuts were made to reduce costs, while 4.4% were as result of AI"; "In October alone, US companies announced 153,074 job cuts, the worst October in 22 years"]

[^38]: Trading Economics data, 19 November 2025. Japan 30-year bond yield: 3.31%; 40-year yield: 3.697% (all-time high). CNBC Asia markets reporting confirmed yields highest since 2008.

[^39]: Park, Jeff [@dgt10011]. Twitter/X post, 19 November 2025. ["Japan's 30y bond yield has never been higher in history than it is now. The global carry machine is on life support."] Includes chart showing yield spike.

[^40]: Market Indicators Tracker COMPREHENSIVE versions [Detailed 2007 vs 2025 comparison showing parallel patterns in VIX, credit spreads, sophisticated investor positioning, timing of stress recognition]

[^41]: Financial Times article, 13 November 2025. "US tech rally has run out of steam." [Quote: "Growing number of investors have drawn comparisons between powerful rise in AI stocks and ill-fated tech boom at turn of millennium"]

[^42]: Ibid. [Goldman Sachs quote: "We see growing risk that imbalances that built up in the 1990s will become more visible as the AI investment boom extends"]

[^43]: Fitch, Asa. "AI Is Making Big Tech Weaker." The Wall Street Journal, 16 November 2025, 5:30am ET. [Subtitle: "Balance sheets, cash flows are showing the strain of AI investments and forcing investors to think about companies differently"]

[^44]: Market Indicators Tracker COMPREHENSIVE 18Nov2025.md [Sundar Pichai Google CEO quote: "There is some irrationality in the current AI boom. I think NO company is going to be immune, including us"; Source: Wall St En... @wallsten... BBC interview; Degree of Certainty: Very High 95%+]

[^45]: Dayen, American Prospect op. cit. ["Financial policymakers I've talked to are perhaps most alarmed by this part" - regarding private credit loading into 401(k) plans]

ANNEX: PROJECT KNOWLEDGE DATA

A. Sophisticated Investor Exits - Complete Timeline

Michael Burry (Scion Asset Management)

- Date: 27 October 2025

- Action: Announced complete fund liquidation

- Rationale: "My estimation of value in securities is not now, and has not been for some time, in sync with the markets"

- Prior Positions: £142m ($186.6M) NVIDIA puts (13.5% of fund); £693m ($912.1M) Palantir puts

- Historical Context: Current AI short 70% LARGER than his famous 2008 housing short (which peaked at ~8% of fund)

- Source: Scion investor letter, 27 October 2025

- Degree of Certainty: Extremely High (100%) - Signed letter to investors

Peter Thiel (Thiel Macro LLC)

- Date: Q3 2025 (disclosed 16 November 2025)

- Action: Sold ENTIRE NVIDIA position

- Details:

- 537,742 shares (~£76M/$100M)

- NVIDIA was 40% of disclosed equity portfolio → 0%

- Total portfolio reduction: 65% (£161M → £56M)

- Also sold ALL Vistra Energy (208,747 shares)

- Cut Tesla by 76% (272,613 → 65,000 shares)

- Remaining: Only 3 stocks - Tesla (38.83%), Microsoft (34.09%), Apple (27.08%)

- Context: Exited whilst NVIDIA at $5 trillion peak, data centre revenues +56%, analysts projecting $1tn annual sales by 2030

- Prior Warning (July 2024): Warned 80-85% of ALL AI profits going to NVIDIA was "very strange"; AI hype cycle running ahead of economics

- Source: SEC 13F filing Q3 2025

- Degree of Certainty: Extremely High (100%) - Public SEC filing

Warren Buffett (Berkshire Hathaway)

- Date: Q3 2025

- Position: £289 billion ($381.7bn) cash - all-time record

- Context:

- More cash than Apple, Amazon, Alphabet, Microsoft COMBINED

- Refusing to buy back Berkshire's own shares despite price decline

- 12th consecutive quarter of net selling

- Source: Berkshire Hathaway SEC filings

- Degree of Certainty: Extremely High (100%)

Bill Gates (Gates Foundation)

- Date: Q3-Q4 2025

- Action: Dumped 65% of Microsoft holdings

- Value: £6.7 billion ($8.8bn)

- Context: Gates co-founded Microsoft; Foundation historically large holder

- Source: Barchart, WhaleWisdom filings

- Degree of Certainty: High (90%+)

SoftBank Group

- Date: October 2025

- Action: Sold ENTIRE NVIDIA position

- Details: 32.1 million shares (~£4.4bn/$5.83bn)

- Context: After years as major NVIDIA holder

- Source: Multiple financial press reports

- Degree of Certainty: Very High (95%+)

Ray Dalio (Bridgewater Associates)

- Date: Q3 2025

- Action: Cut NVIDIA position by 64%

- Source: 13F filing

- Degree of Certainty: Very High (95%+)

Viking Global Investors

- Date: Q3 2025

- Action: Eliminated entire NVIDIA position

- Details: 3.7 million shares (£441m/$582M)

- Source: 13F filing

- Degree of Certainty: Very High (95%+)

Saudi Arabia Public Investment Fund (PIF)

- Date: Q3 2025

- Action: Reduced US equity holdings by 18%

- Value: £14.7 billion ($19.4bn)

- Positions Exited: 9 complete exits from US holdings

- Context: Concurrent with being courted for AI infrastructure funding

- Source: 13F filing

- Degree of Certainty: Very High (95%+)

Jensen Huang (NVIDIA CEO) - Insider Selling

- Period: Multiple months through November 2025

- Rate: £13 million ($17m) per day

- Pattern: 75,000 shares per transaction, repeatedly

- Context: Systematic liquidation concurrent with:

- Presidential endorsement (19 Nov)

- Company at $5tn market cap peak

- Burry/Thiel/SoftBank exits

- Source: SEC Form 4 filings; AI Breakfast social media documentation

- Degree of Certainty: Very High (95%+)

B. Credit Market Stress Indicators

Oracle Credit Default Swaps

- July 2025: Initial spike to ~80-100 bps

- Chart Title (BofA): "Trouble in Paradise"

- November 2025: Reached 105 bps (3-year high)

- Interpretation: Elevated default risk pricing

- Source: Bank of America Research; Bloomberg data; Global Markets Investor

- Degree of Certainty: Very High (95%+)

AI Sector-Wide CDS Spike (14 November 2025)

- Companies Affected: Oracle, SoftBank, Amazon, Google, NVIDIA

- Pattern: Simultaneous spikes across all major AI infrastructure companies

- Interpretation: Credit derivatives market pricing elevated default risk across entire sector

- Source: THE SHORT BEAR social media post with charts

- Degree of Certainty: High (90%+)

Cash Credit Spreads

- High-Yield Spread: 2.56-2.81% (late October-November 2025)

- Historical Context: Matches March 2007 pre-crisis levels exactly

- Pattern: Derivatives pricing risk; cash markets haven't repriced yet (classic pre-crisis divergence)

- Source: CME Group, Vaulted, multiple market data providers

- Degree of Certainty: High (95%+)

C. Real Economy Deterioration

Employment

- Job Cuts (Jan-Oct 2025): 1,099,500 (2nd-highest since 2009)

- AI-Related Cuts: 4.4% explicitly attributed to AI

- October 2025: 153,074 cuts (worst October in 22 years)

- October Breakdown:

- 32.9% cost-cutting

- 20.3% AI-related

- 13.8% market/economic conditions

- Jobs Data Cancellation: October 2025 report cancelled (first time since 2013)

- Source: The Kobeissi Letter; US Labor Department

- Degree of Certainty: Very High (95%+)

Commercial Real Estate

- CMBS Office Delinquency Rate: 11.8% (November 2025)

- Historical Context: Highest on record; WORSE than 2008 crisis peak (~11%)

- Data Range: Records back to 2000

- Source: Charlie Bilello; Trepp

- Degree of Certainty: Very High (95%+)

Consumer Credit

- Foreclosures: Up 20% year-over-year

- Subprime Auto Delinquencies: 30-year highs

- Credit Card Defaults: Rising

- Consumer Sentiment: Business Insider reports "signs of real distress on the way"

- Source: Jesse Cohen; Business Insider (18 Nov)

- Degree of Certainty: High (90%+)

Leading Indicators

- Lumber Prices: Lowest price of 2025

- Freight: Declining

- Construction: Weak

D. AI Financial Engineering Structure

Special Purpose Vehicles (SPVs)

- Purpose: Hide debt off Big Tech balance sheets

- Structure:

- SPV builds data centre

- Big Tech takes minority stake (typically 20%)

- SPV carries debt

- Big Tech lease payments flow to debt investors

- Example: Meta Hyperion (Louisiana)

- Value: $30 billion

- Blue Owl: Majority owner via SPV

- Meta: 20% stake

- Source: The American Prospect (David Dayen)

- Degree of Certainty: Very High (95%+)

Private Credit Market

- Size: $1.6 trillion (February 2025)

- Characteristics: Unregulated lending outside banking system

- Blue Owl: $295 billion AUM

- Crisis Signal: Blue Owl blocking redemptions (November 2025)

- Automatic 20% losses for investors

- Unable to meet withdrawal requests

- Source: The American Prospect; Wall Street Journal; Blue Owl SEC filings

- Degree of Certainty: Very High (95%+)

Asset-Backed Securities

- Composition: 61% from data centres

- Structure: Securitise data centre assets into tranches

- Problem: Securitising assets years into depreciation cycle

- Asset Life: 2-3 years (GPUs under AI workload)

- Debt Term: 10-15 years

- Gap: Massive asset-liability mismatch

- Source: Centre for Public Enterprise report; The American Prospect

- Degree of Certainty: High (90%+)

E. Accounting Fraud Mechanism (Burry's Baidu Analysis)

The Depreciation Extension

- Company: Baidu (Chinese AI firm)

- Change:

- 2021: Server useful life 4-5 years

- 2024: Server useful life 5-6 years

- Impairment Taken: RMB 16.2 billion on RMB 30.1B net PPE (over 50%)

- Result: Net income rose over 50% from accounting change alone

- Physical Reality: AI servers under heavy workload last 2-3 years

- Accounting Fiction: Depreciating over 5-6 years

- Fraud Magnitude: Earnings inflated 50%+

- Future Impact: When replacement needed, massive unexpected CapEx

- Sector Application: Burry implied this pattern extends across AI sector

- Source: Michael Burry Twitter/X analysis with highlighted Baidu financial documents (19 Nov 2025)

- Degree of Certainty: Very High (95%+) on Baidu specifics; High (85%+) on sector-wide pattern

Expert Corroboration

- David Dayen (American Prospect): "If the GPUs are working overtime to compute AI models, they may not last more than two years, and high-end AI firms will always want to upgrade to the latest version anyway."

- Finding: "AI firms are extending their depreciation schedules for the GPUs; they're saying they will last much longer than they likely will."

- Consequence: "Overstated revenues, as companies have to purchase far more GPUs than they are admitting publicly, and thence possible financial disaster."

F. OpenAI Infrastructure Commitments (Unfunded)

Total Commitments: £380-500+ billion ($500-660+ billion)

Partnership Structure:

- Oracle: Data centre infrastructure ($300bn announced October 2025)

- NVIDIA: Up to £76bn ($100bn) AI chips and infrastructure

- Broadcom: Custom AI accelerator chips (multi-year, value TBD)

- AMD: MI300 series accelerators (value TBD)

Capacity Commitments:

- Current Operations: "Just over 2 gigawatts"

- Committed: 33+ gigawatts

- Increase: 16x current capacity

Financial Reality:

- OpenAI 2024 Revenue: ~£1.5bn ($2bn)

- Projected 2030 Revenue: £152bn ($200bn) - required to justify commitments

- Current Status: Losing £11.5bn ($15.2bn) per quarter

- Financing Plan: None disclosed; spokesperson declined comment

Market Impact:

- Oracle: -£315bn (-$415bn) market value in 10 weeks following announcement

- Pattern: Largest AI infrastructure deal → Largest value destruction

Sources: Company press releases October 2025; The American Prospect; Market Indicators Tracker Degree of Certainty: Very High (95%+) on commitments and current losses; High (85%+) on projected 2030 revenue; Very High (95%+) on Oracle value destruction

G. Mainstream Warnings (November 2025)

Financial Times (13 November)

- Quote: "Growing number of investors have drawn comparisons between powerful rise in AI stocks and ill-fated tech boom at turn of millennium"

- Market Response: Nasdaq -2.3%, S&P 500 -1.7% on publication day

- Source: FT article "US tech rally has run out of steam"

- Degree of Certainty: Very High (100%)

Goldman Sachs (13 November)

- Quote: "We see growing risk that imbalances that built up in the 1990s will become more visible as the AI investment boom extends"

- Significance: Major investment bank explicitly comparing to dot-com bubble

- Source: Quoted in Financial Times

- Degree of Certainty: Very High (100%)

Wall Street Journal (16 November)

- Headline: "AI Is Making Big Tech Weaker"

- Subtitle: "Balance sheets, cash flows are showing the strain of AI investments and forcing investors to think about companies differently"

- Quote: "Weaker cash balances, less cash flow, more debt—are beginning to fundamentally alter the tech-company business model"

- Author: Asa Fitch

- Significance: Mainstream financial press confirming fundamental degradation

- Source: WSJ article 16 Nov 2025, 5:30am ET

- Degree of Certainty: Very High (100%)

Google CEO Sundar Pichai

- Quote: "There is some irrationality in the current AI boom. I think no company is going to be immune, including us"

- Significance: CEO of Magnificent 7 company admitting bubble risk

- Source: BBC interview, reported widely

- Degree of Certainty: Very High (95%+)

H. Infrastructure Constraints

Power Shortfall

- Gap: 44 GW (equivalent to 44 nuclear power plants)

- Infrastructure Cost: £3.5 trillion ($4.6 trillion) required

- BlackRock-NVIDIA Deal: £30bn ($40bn) addresses only 11% of shortfall

- Source: Morgan Stanley research; multiple reports

- Degree of Certainty: High (90%+)

The Atlantic Investigation (30 October 2025)

- Location: New Carlisle, Indiana

- Current: 7 data centres built

- Planned: 23 additional data centres

- Power Consumption: "More than two Atlantas" when complete

- Current Demand: 500+ megawatts

- Authors: Matteo Wong and Charlie Warzel

- Degree of Certainty: Very High (95%+)

I. Market Concentration Risk

AI Sector Concentration

- 41 AI-related stocks: 8% of S&P 500 by count

- Market Capitalisation: 47% of S&P 500 total market cap

- Comparison: "WELL above the 2000 Dot-Com Bubble"

- Source: Global Markets Investor analysis (19 Nov 2025)

- Degree of Certainty: Very High (95%+)

META Example

- Price (August 2025): ~£595 ($784)

- Price (November 2025): ~£446 ($587)

- Decline: ~£149 ($197) or ~25% in 3 months

- Forward P/E: 19.8x (still elevated)

- Significance: Even "Magnificent 7" leaders showing weakness

- Source: Dividend Talks analysis

- Degree of Certainty: Very High (100%)

J. Japan Carry Trade Breakdown (19 November 2025)

Bond Yields (Record Levels)

- 10-Year: 1.759% (highest since 2007)

- 20-Year: 2.815% (highest since 1999)

- 30-Year: 3.31% (near record highs)

- 40-Year: 3.697% (all-time record high)

Auction Weakness

- 20-Year Sale: Bid-to-cover ratio 3.28 vs 3.56 previous month

- Interpretation: Investor caution about future supply

- Context: Prime Minister Takaichi's economic package plans

Global Implications

- Carry Trade: Decades of borrowing in yen at near-zero rates to invest globally

- Current Status: Breaking down as Japanese yields spike

- Effect: Forces unwinding of leveraged positions globally

- Jeff Park Assessment: "The global carry machine is on life support"

Sources: Trading Economics; Bloomberg; CNBC Asia; Jeff Park Twitter/X Degree of Certainty: Very High (100%) on yield levels; Very High (95%+) on carry trade implications

K. Analyst Quotes

David Dayen (American Prospect):

"We have a 2000s housing bubble level of financial engineering on top of a 1920s level of private unregulated lending on top of something bigger than a 1990s internet (or 1870s railroad) level of technology and infrastructure build-out. It's one bubble to rule them all."

"Everyone's all in on data centers now; we're in bubble inflation territory, and it's unclear when it will pop."

"There's a whole middleman aspect to this as well, the 'neoclouds' that build data centers on spec and rent them out. (CoreWeave is a terrifying debt-ridden entry in this genre.)"

Former Congressional Staffer (quoted in American Prospect):

"We have sealed the deal on another financial crisis—the question is size."

Michael Burry (27 October 2025 investor letter):

"With a heavy heart, I will liquidate the funds and return capital - but for a small audit/tax holdback - by year's end. My estimation of value in securities is not now, and has not been for some time, in sync with the markets."

Peter Thiel (July 2024, context for Q3 2025 exit):

"80-85% of all profits in AI going to NVIDIA is very strange." [Warning that AI hype cycle running ahead of economics]

Sundar Pichai (Google CEO, November 2025):

"There is some irrationality in the current AI boom. I think no company is going to be immune, including us."

L. Timeline of Escalation (October-November 2025)

27 October: Michael Burry announces fund liquidation 30 October: The Atlantic publishes "Here's How the AI Crash Happens" 13 November: Financial Times and Goldman Sachs issue bubble warnings; Nasdaq falls 2.3% 14 November:Credit default swaps spike across ALL major AI companies simultaneously 15 November: Blue Owl blocking redemptions documented; consumer distress warnings intensify 16 November: Wall Street Journal publishes "AI Is Making Big Tech Weaker"; Peter Thiel 13F filing shows complete NVIDIA exit; Saudi PIF 13F shows 18% US equity reduction 18 November: White House dinner with Trump, MBS, Huang, Cook, Musk; Oracle CDS hits 105 bps; commercial real estate delinquencies hit record 11.8%; Business Insider reports consumer "real distress"; Baidu accounting analysis by Burry 19 November: Trump posts NVIDIA endorsement hours before earnings; Japan bond yields spike to crisis levels; XAI-Saudi-NVIDIA deal announced; Jobs data cancelled; The American Prospect publishes comprehensive bubble analysis

Pattern: Accelerating convergence of multiple stress indicators over 23-day period

NOTES ON CERTAINTY LEVELS

Very High Certainty (95-100%)

- SEC filings (13F, Form 4) - public record

- Company earnings and financial disclosures

- Published articles in established financial press

- Government bond yield data

- Market price data

High Certainty (85-95%)

- Reported deals with company confirmation

- Credit default swap data from established sources

- Analyst reports from major institutions

- Pattern analysis based on multiple corroborating sources

Moderate-High Certainty (75-85%)

- Export rule changes (widely reported as in preparation, not yet formally published)

- Some specific deal terms (announced but full details not disclosed)

- Causal connections requiring inference (e.g., tariffs → specific farm sales)

Moderate Certainty (60-75%)

- Future projections and timeline estimates

- Indirect causation (e.g., tech billionaire land purchases linked to agricultural distress)

- Some aspects of geopolitical negotiations (public statements vs. private agreements)

Items Noted as "Announced as Expected but Not Confirmed"

- Specific terms of Saudi AI infrastructure commitments beyond publicly announced deals

- Full details of export rule changes (in preparation, not yet formally published)

- Precise financing structures of some SPV arrangements

- Complete scope of Round-tripping circular financing (deliberately opaque)

LEGAL DISCLAIMER: This documentary script is based on publicly available information, SEC filings, published financial analysis, and market data available as of 19 November 2025. Future events depicted in Act IV are speculative projections based on historical patterns. Viewers should conduct their own research and consult financial advisors before making investment decisions.

May still keep updating this when I have a few minutes free. This much diving down financial rabbit holes has to have an outlet somewhere and no-one in my circle has much interest. I mix with normal people who get up, go to work, come home. tell me about their day, then think about what to have for dinner. Going to keep updating this when I have a few minutes free. This much diving down financial rabbit holes has to have an outlet somewhere and no-one in my circle has much interest. I mix with normal people who get up, go to work, come home, tell me about their day, then think about what to have for dinner.