When I'm not doing things around tech I watch signals elsewhere. The last but one rant (sorry, post) talked about AI bubbles with little to no reference out to sources, but easy to verify detail. Today's crop of signals has me checking family finances.

Warren Buffet - Big Short character 1 - has taken a humongous T-Bill position, apparently unable to find attractive investment opportunities in overinflated equity markets. Pulling back from Apple and Bank of America holdings.

Michael Burry - Big Short character 2 - has taken big short positions against both NVIDIA and Palantir - pretty pure AI plays. Alex Karp is fuming.

To quote Alex Karp, as reported in the Washington Post this morning:

“It just is super triggering because these people … they can pick on any company in the world; they have to pick on the one that actually helps people, that actually has made money for the average person, that is actually helping our warfighters,” Karp said, swinging his arms up and down with closed fists and calling Burry “bats— crazy” for betting against AI. WaPo 5th November

Altman and Nadella - Future Big Short characters 4 & 5? - were out there talking about a glut of compute. With Altman it was delivered in a typical 'I may be wrong, but I think this is true' sage teacher tone, highlighting the power pinch point over the chip pinch point this time. First Nadella:

“The cycles of demand and supply in this particular case you can’t really predict,” Nadella said on the BG2 podcast. “The biggest issue we are now having is not a compute glut, but it’s a power and it’s sort of the ability to get the [data center] builds done fast enough close to power.”

“If you can’t do that, you may actually have a bunch of chips sitting in inventory that I can’t plug in. In fact, that is my problem today. It’s not a supply issue of chips; it’s the fact that I don’t have warm shells to plug into,” Nadella added, referring to the commercial real estate term for buildings ready for tenants. Nadella, Tech Crunch, 3rd November

Alman now, talking about impatient tech firms throwing up data centre infrastructure. Making a pitch for 'behind-the-meter' arrangements, where electricity is fed directly to sites, skipping the grid.

“If a very cheap form of energy comes online soon at mass scale, then a lot of people are going to be extremely burned with existing contracts they’ve signed.”

One last quote you all have to measure on your hopium / copium metre - on Jevons paradox, which says that more efficient use of a resource will lead to greater use.

“If the price of compute per like unit of intelligence or whatever — however you want to think about it — fell by a factor of a 100 tomorrow, you would see usage go up by much more than 100 and there’d be a lot of things that people would love to do with that compute that just make no economic sense at the current cost,”

This, you have to remember, is a firm that just restructured their exclusive deal with Microsoft to dive into a competitive compute and funding market.

At almost the same moment signing a huge deal with Amazon ($38bn for cloud services). A key motive was to secure funding SoftBank made conditional. In April Softbank committed to $40bn financing, $10bn in April, the rest depended on restructuring to make a public offering possible in future. The deadline was 31st December 2025. The Information first reported the funding is now approved.

What is happening right now?

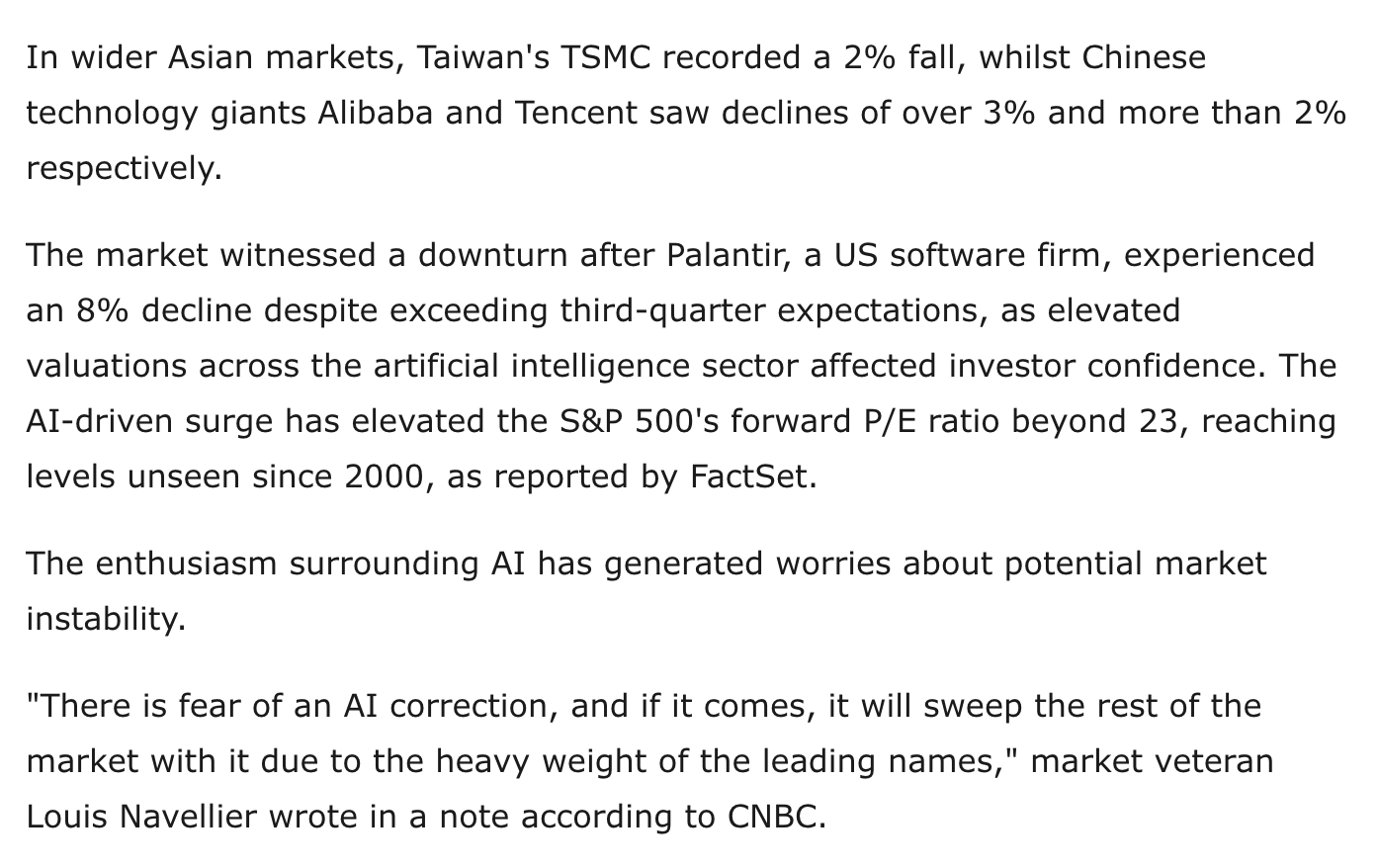

SoftBank - Future Big Short character 6? - Here reporting from India on early trading 5th November.

The wider AI market signals from the same article:

No, I am not a market analyst or deep economic specialist, but against the backdrop of prior articles in niche outlets such as the Financial Times, a big AI hype bill seems about to come due. I hope I am wrong. My and many other lives are likely to be impacted. The Cassandra Club has no willing members.

“Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play,” Burry said in an Oct. 30 post on X.

Fine and dandy for people with sufficient wealth to step away from the game.